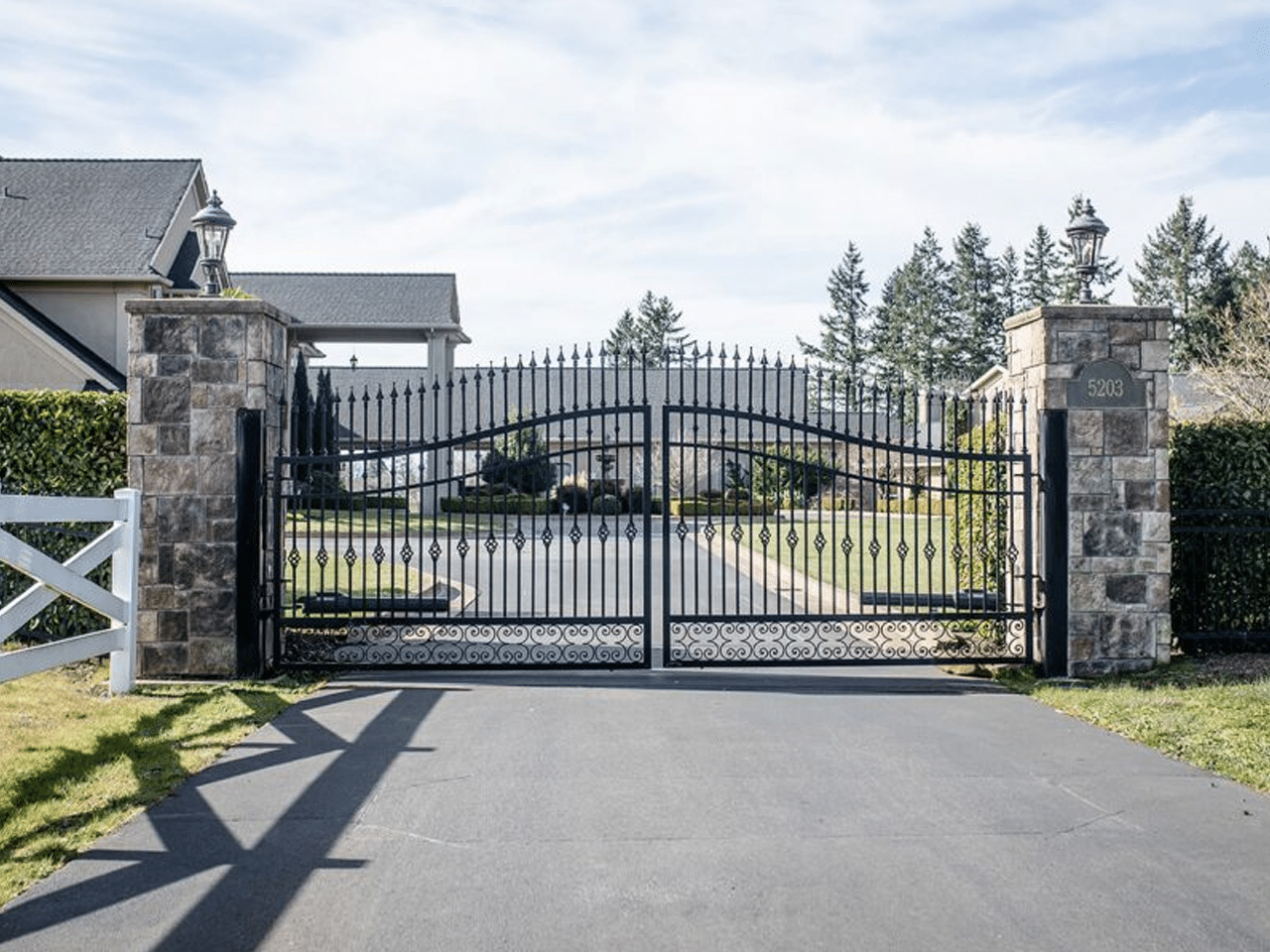

Your home is more than just a roof over your head; it’s a reflection of your style and a sanctuary for your family. When it comes to enhancing the aesthetics of your property, the choices you make for external features can have a profound impact. Siding, roofing, gutters and guards, and windows are not just functional elements of your home; they can also transform its appearance and increase its value.

In this ultimate guide, we will explore how each of these components contributes to the overall beauty and functionality of your home. From the sleek lines of modern siding to the sturdy protection of a well-designed roof, and from the practical benefits of effective gutters to the elegance of beautifully framed windows, each aspect deserves careful consideration. Join us as we delve into the best options available, tips for maintenance, and trends that will elevate your home’s curb appeal.

Choosing the Right Siding

Selecting the right siding for your home is crucial not only for aesthetic appeal but also for durability and maintenance. The market offers a wide array of siding materials, including vinyl, wood, and fiber cement, each with its unique characteristics. Vinyl siding is popular due to its low maintenance and variety of colors, while wood siding offers a classic, warm appearance that can enhance a home’s charm. Fiber cement board, on the other hand, provides excellent durability and can mimic the look of wood without the same level of upkeep.

When considering siding, think about the climate in your area and how different materials perform under varying conditions. For instance, in regions with extreme weather, durable options like fiber cement may be preferable, as they resist rot, warping, and fire. Additionally, it’s important to factor in energy efficiency. Insulated siding can provide extra protection against temperature fluctuations, contributing to lower energy bills and a more comfortable home.

Lastly, aesthetics play a significant role in your choice of siding. Consider the architectural style of your home and the overall look you want to achieve. Coordinating the siding color and texture with your roofing and exterior elements will create a cohesive look, enhancing your home’s curb appeal. Take your time to explore different options and consult with professionals to ensure that your choice aligns with your vision and practical needs.

Roofing Options for Every Style

When selecting the right roofing for your home, it’s essential to consider both aesthetics and functionality. Traditional asphalt shingles offer versatility and a wide range of colors to match various siding styles. They are popular due to their affordability and ease of installation, making them a top choice for many homeowners. For a classic look, wood shakes can bring warmth and charm, although they may require more maintenance over time due to potential rot and insect damage.

For those looking to make a bold statement, metal roofing has gained popularity in recent years. This option is not only durable and energy-efficient but also available in an array of colors and finishes that can mimic the look of traditional materials like slate or tile. Metal roofs can complement modern and contemporary homes beautifully, providing a sleek and polished aesthetic. Additionally, their longevity makes them a worthwhile investment in terms of cost-effectiveness.

Clay and concrete tiles are excellent choices for homes with Mediterranean or Spanish influences. These materials offer durability and unique styling, and they can withstand harsh weather conditions while requiring minimal maintenance. However, due to their weight, it is crucial to ensure that your home’s structure can support them. Ultimately, the right roofing option should reflect your personal style while providing the protection your home needs.

Essential Gutter and Window Solutions

Gutters play a crucial role in protecting your home from water damage, making it essential to choose the right gutter system for your needs. High-quality gutters can effectively channel rainwater away from your roof and foundation, safeguarding your property against erosion, mold, and structural damage. Modern materials such as aluminum and vinyl offer durability and require minimal maintenance. Additionally, consider adding gutter guards to your system; these can significantly reduce clogs from debris, allowing for a more efficient water flow and less frequent cleaning.

When it comes to windows, they not only enhance the aesthetic appeal of your home but also contribute to energy efficiency. Selecting energy-efficient windows can reduce heating and cooling costs while improving indoor comfort. Look for options that feature double or triple glazing, low-emissivity coatings, and proper sealing to minimize heat transfer. Furthermore, decorative window designs can elevate your home’s style, allowing you to choose between various shapes, sizes, and finishes that complement your overall design vision.

Integrating both quality gutters and windows is essential for a comprehensive home improvement strategy. Together, they work to enhance your home’s functionality, efficiency, and curb appeal. By prioritizing these elements, you not only ensure the longevity of your property but also create a more inviting environment that reflects your personal style. Investing in these solutions is a vital step toward elevating your home’s aesthetics and value.